Annual Report for 1 January - 31 December 2020

The Annual Report was presented and adopted at the Annual General Meeting of the Company on 27/4 2021.

Torben Bang, Chairman of the meeting KIRK KAPITAL A/S

Annual Report for 1 January - 31 December 2020

The Annual Report was presented and adopted at the Annual General Meeting of the Company on 27/4 2021.

Torben Bang, Chairman of the meeting KIRK KAPITAL A/S

Introduction

Established in 2007, Kirk Kapital’s heritage stretches back much further to 1932, when Ole Kirk Christiansen started making wooden toys in his workshop. In 1934, Ole began selling them under the now world-famous name, LEGO.

Today, almost 90 years later, our heritage of imagination and ingenuity is what forms the foundation of Kirk Kapital’s unique business.

Kirk Kapital’s shareholders, the Kirk Johansen family, are Ole Kirk Christiansen’s descendants.

As well as managing the family office services for our shareholders, we specialise in financial investments and strategic minority investments in tomorrow’s best companies, under the motto:

We invest, collaborate and create.

Our purpose is to create longterm prosperity for the families of our shareholders, partners and employees.

While we are patient and longer-term focused, we are very pleased and proud to state that our Investment Result in 2020 was DKK 486 million. Considering the turbulent year, heavily impacted by the effects of COVID-19, we are very pleased with the outcome. The result was driven by both our Strategic Investments and our Financial Investments, while our Vejle Investments contributed negatively.

Continuing the trend from 2019, we have in 2020 decreased our capital allocation to Vejle Investments, while we have increased our allocation to both Strategic Investments and Financial Investments.

On December 1, 2020, we announced the establishment Kirk Kapital Fondsmæglerselskab A/S, a 100% owned subsidiary of Kirk Kapital. The asset management company will manage all of our activities within Financial Investments. This includes the management of six larger portfolios as well as several smaller portfolios.

Going forward, we will be measured against the highest standards in relation to, e.g., compliance, reporting and risk adjusted returns.

In summary, 2020 has been a satisfactory year. For 2021, we expect a positive Investment Result at, or above DKK 250 million. However, in light of the continued uncertainty relating to the follow-on impacts from COVID-19, the expectation is associated with significant risk. No events have occurred after the balance sheet date which is considered to have a material impact on the assessment of the Annual Report.

Kirk Kapital is a trusted leader within larger minority investments with an active ownership agenda. Our scope is medium- and largersized companies which have market-leading positions in longerterm growth industries, primarily with headquarter in Scandinavia.

Today, our larger minority equity portfolio includes a range of 14 companies within business services and light manufacturing. In 2020, we added 2 companies to our portfolio, namely, Dansk Træemballage and Danske Stenhuggerier, while we divested our shareholding in PNO. Further, in January 2021, we added the first Norwegian company, VivoMega, to our portfolio.

Our Investment Result in 2020 is DKK 405 million, or 14% return, and the asset base by year-end is DKK 3,443 million.

The performance is considered satisfactory, and above our longerterm expectations, especially in light of the turbulence following the follow-on effects from the COVID-19 pandemic. The positive development is derived from a broad positive contribution from the portfolio companies.

Kirk Kapital Fondsmæglerselskab manages multiple individual portfolios tailored to our partners’ precise needs. All portfolios managed consist of a wide range of investments including both listed equities, fixed income, and alternatives. The portfolios represent, in total, a value above DKK 6.7 billion. The largest portfolio is Kirk Kapital’s own Financial Investments portfolio, and it represents 35% of Kirk Kapital’s own asset base.

Kirk Kapital’s own Financial Investments portfolio generated a result in 2020 of DKK 123 million, or 6% return, and the asset base by year-end is DKK 2,152 million. We have benefitted from the development in the general markets, especially the stock market. Further, our over-allocation to growth exposed equities, provided us with a return well above the general stock market. In summary, we have delivered a result better than our expectations.

Kirk Kapital has a number of activities in the Vejle area. This is due to our continued support and veneration to the community in Vejle.

Our Investment Result in 2020 is DKK -42 million, and our net asset base is DKK 550 million. The negative result is lower than last year but broadly line with our expectations.

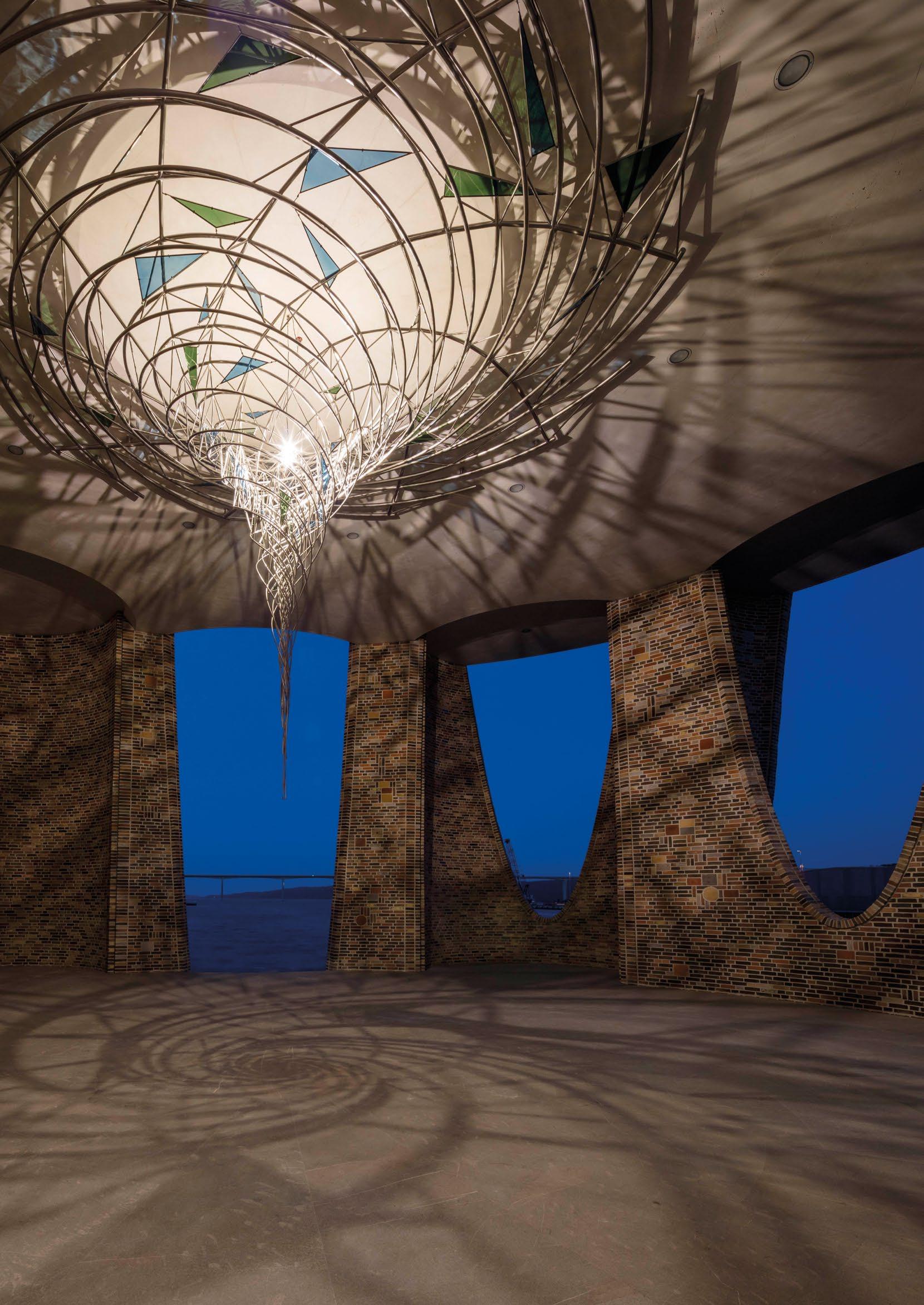

We continue to be very pleased with how the local community has embraced our new headquarter, Fjordenhus, and its surroundings on Havneøen. The ground floor of Fjordenhus is an integral part of the publicly accessible space in Vejle. In 2020, around 125.000 visitors have chosen to spend time at Fjordenhus.

In December, it was announced that we had entered into an agreement with Zleep Hotels, whereby Kirk Kapital will build a 12-floor hotel with 124 rooms, and Zleep Hotels will be the operator. This project will complete Kirk Kapital’s development of Havneøen in Vejle, a project which was initiated more than 10 years ago.

Kirk Kapital’s purpose is to create long-term prosperity for the families of our shareholders, partners and employees. We manage and grow family-owned capital, based on strong family values.

Within Strategic Investments, our investment scope is Scandinavian medium- and largersized companies having marketleading positions in long-term growth industries. Our minority equity portfolio currently includes a range of business-tobusiness companies within services and light manufacturing.

We aim to expand this portfolio in the years to come. Our unique model for active minority investment ensures the independence of our partners, while creating the best possible conditions for their lasting success. We achieve this by providing active board representation, the benefits of our toolbox and shared best practice across our portfolio. Common to all cases is a tailored approach, closely calibrated with our partners’ requirements and wishes. Altogether, this creates the best conditions for each company’s long-term growth.

Within Financial Investments, we manage multiple individual portfolios which we seek to tailor to our partners’ precise needs. The portfolios consist of a wide range of investments including both listed equities, fixed income, and alternatives.

Within Vejle Investments, we seek to support our long-term commitment to Fjordenhus and the finalisation of the development of Havneøen. This is due to our veneration and continued support to the community in Vejle.

Competence

We are amongst the best, brightest, and most experienced within our field

Dedication

We have a relentless focus on realizing our purpose

Integrity

We conduct our business in accordance with the highest standards of professional behavior and ethics

It is Kirk Kapital’s clearly defined intention to run a responsible business in every respect and at any time. Our organisation handling our activities, and our directly controlled subsidiaries, is small, consisting of 29 employees. In this light, values and expectation in relation to social responsibility are informally shared.

Besides our IT policy, employee handbook and data policy, Kirk Kapital, and its directly controlled subsidiaries, has at this point no other formalised policies regarding CSR. The reasons for this are further addressed below for each subject matter.

Kirk Kapital’s activities consist of larger minority shareholdings and investments in non-controlled financial investments. Although due consideration to CSR have been given to all of our investments, Kirk Kapital is currently working on formalising an investment policy stipulating our CSR values together with strengthening our compliance policies. As part of this process, Kirk Kapital Fondmæglerselskab A/S has in 2020 applied to join UNPRI and UN’s Clobal Compact.

Kirk Kapital, and its directly controlled entities, has been evaluating our risk of violating any human rights in connection with its business activities. Since we are conducting our business under Danish legislation, which is highly regulated with regards to human rights, the risk of violating human rights is considered low.

Kirk Kapital, and its directly controlled subsidiaries, has little risk of abnormal negative environmental impact since Kirk Kapital, and its directly controlled subsidiarises, is conducting its main activities in Denmark where legislation provides guidelines and restrictions on good environmental behaviour.

Anti-corruption and compliance

Kirk Kapital, and its directly controlled subsidiaries, has a limited amount of business partners and aims to always comply with current legislation and guidelines regarding anticorruption issues. Due to the limited amount of business partners, the risk of violating anti-corruption legislation is considered low.

Formalising existing compliance procedures as well as establishing formal policies in areas with only informal procedures is an area of focus.

Employees including statement on gender composition

Since the establishment of Kirk Kapital in 2007, employee welfare has been a prioritised focus. We have a family-like and trustbased working environment. Our employee policy consists of an employee handbook made available to the employees.

The employee handbook provides practical guidance and rules on various employee topics, for example work environment and professional development.

The most significant risks to our employee’s welfare are considered to be work overload and stress. A small and flat organisation enables management to observe the risks on a continuous basis. In 2019, Kirk Kapital implemented a formal anonymous employee satisfaction survey, which will be performed yearly, to verify management observations and detect improvement areas early. In 2020, the employee survey concluded that the employees were very satisfied overall.

We do our outmost to treat employees equally and always to select candidates based on qualifications and suitability. This has always been the case in the past and will also be the case in the future.

The distribution of female/ male members on the Parent

Company’s Board of Directors is 25%/75%, which is defined as equal distribution of gender according to guidelines issued by the Danish Business Authority. Therefore, no further reporting on Board of Directors level is performed. The distribution of female/male employees is close to 50%/50%.

As Kirk Kapital, during the financial year, has had less than 50 employees, we have not prepared a policy on the gender distribution on other management levels, in accordance with the rules.

As a family-owned business and investment company we are widely exposed to financial risks, especially relating market risk, with an exposure to publicly traded securities.

Our three investment departments are managing financial risks with the objective to create long-term prosperity for the families of our partners. In this light, we have not taken any risks that could be referred as special considering the extent

of our activities as an investment company.

For further information about financial risk management we refer to note 19 in the Group’s financial statements.

Accounting policies Critical accounting estimates and judgements Strategic Investments

Financial Investments

Vejle Investments Expenses

Staff expenses

Income tax

Strategic Investments

Financial Investments

Vejle Investments

Property, plant, equipment and leasehold improvements

Investment properties

Investments in subsidiaries

Investment in associates and joint ventures at fair value

Other equity investments

Lease assets - right-of-use assets

Deferred tax

Share capital

Related parties

Commitments and contingent liabilities

Financial risk management

Lease liabilities

Events after the balance sheet date

1 Accounting policies

The financial statements are presented in Danish Kroner (DKK), as this is the Company's functional currency.

The financial statements have been rounded to the nearest million.

The financial statements of the Parent Company have been prepared in accordance with International Financial Reporting Standards (IFRS) as adopted by the EU and additional Danish disclosure requirements.

The accounting policies are the same as for the Consolidated Financial Statements, refer to note 1 for the Group.

2 Critical accounting estimates and judgements

Critical accounting estimates and judgements is specified in the Consolidated Financial Statements, refer to note 2 for the Group.

3 Strategic Investments

Income from subsidiaries

Income

Investment properties consists of rental properties together with forest and agriculture land. Geographical the properties are located either in Vejle or in the vicinity of Vejle.

Investment properties are on initial recongnition measured at cost and subsequnetly at fair value using generally accepted valuation methods. The fair value of rental properties is determined by using either an income capitalization model or basis valuation carried out by independent valuers.

Buildings valued using a capitalizations model is measured at an average rate of return of 6.5% to 7.0%. The average rate of return used, is based on an assessment of locations and condition. A change of the rate of return of 0.5% will impact the value of rental property of approx. DKK 3 million before tax.

The fair value of the forest and agriculture land is estimated at DKK 115,000 per hectare (2019: 115,000 per hectare). A change of the price per hectare of 1% will impact the value of the forest and agriculture land of approx DKK 0.6 million before tax.

in subsidiaries are specified in the Consolidated Financial Statements, refer to note 23 for the Group.

Critical accounting estimates and judgements is specified in the Consolidated Financial Statements, refer to note 2 for the Group.

20 Related parties

Related parties are specified in the Consolidated Financial Statements, refer to note 17 for the Group.

Transactions with related parties:

Year-end balances arising from transactions with related parties:

Other related parties

No other year-end balances or transactions have taken place during the year with the Board of Directors, the Executive Management, major shareholders or other related parties.

21 Commitments and contingent liabilities

Contingent liabilities

Remaining commitment regarding participation in investment projects amount to a maximum of DKK 515m.

Sercurity has been given in investments properties at a net carrying amount of DKK 61m for the mortgage loans.

The Parent Company has provided a guarantee of a maximum of DKK 279m to financial institutions in which the Company's subsidiaries and associates have loans and other engagements.

The Parent Company has entered into a cash pool agreement. As per. 31 December 2020 the net withdrawl on the cashpool aregreement was DKK 77m.

Joint taxation scheme

The Danish group companies are jointly and severally liable for tax on the jointly taxed incomes etc. of the Group. The total amount of corporation tax payable by the Group is disclosed in the Financial Statements for KIRK KAPITAL A/S, which is the management company of the joint taxation. The Danish companies are joint and several liable for the joint taxation liability. The joint taxation liability covers income taxes and withholding taxes on dividends, royalties and interest.

22 Financial risk management

Financial risk factors

Financial risk factors, market risk, credit risks and liquidity risk are specified in the Consolidated Financial Statements, refer to note 19 for the Group.

Maturity analysis

The table below analyses the Parent Company’s financial liabilities into relevant maturity groupings based on the remaining period at the balance sheet date to the contractual maturity date. The amounts disclosed in the table are the contractual undiscounted cash flows.

Non-derivatives

As at 31.12.2020

hierarchy is specified in the Consolidated Financial Statements, refer to note 19 for the Group.

Lease liabilities Lease liabilities expiring within the following periods from the balance sheet date:

In 2020 the Parent has paid DKK 4,4m regarding lease agreements where of interest expenses related to lease liabilities amount to DKK 0,7m and repayment of lease liability amount to DKK 3,7m.

24 Events after the balance sheet date

No events materially affecting the assessment of the Annual Report have occurred after the balance sheet date.

* The company has implemented IFRS on 01.01.2017. The comparative figures for 2016 are presented according to Danish GAAP.

Accounting policies

Critical accounting estimates and judgements

Revenue

Staff expenses

Amortisation, depreciation and impairment losses

Financial income

Financial expenses

Income tax

Property, plant, equipment, leasehold improvements and lease assets

Investment properties

Investment in associates and joint ventures at fair value

Investment in associates and joint ventures at equity method

Other equity investments

Deferred tax

Inventories

Share capital

Related parties

Commitments and contingent liabilities

Financial risk management

Fee to auditors appointed at the general meeting

Lease liabilities

Events after the balance sheet date

List of group companies

1 Accounting policies

The Consolidated Financial Statements are presented in Danish Kroner (DKK), as this is the Group's functional currency. The Consolidated Financial Statements have been rounded to the nearest million.

The consolidated and separate financial statements for KIRK KAPITAL A/S have been prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB) and as adopted by the European Union as well as additional Danish disclosure requirements applying to entities of reporting class C for large enterprises.

Basis of consolidation

The Consolidated Financial Statements comprise the Parent Company, KIRK KAPITAL A/S, and subsidiaries in which the Parent Company directly or indirectly holds more than 50 % of the votes or in which the Parent Company, through share ownership or otherwise, exercises control. Subsidiaries are fully consolidated from the date on which control is transferred to the group. They are deconsolidated from the date that control ceases.

On consolidation, elimination is made of intra-group income and costs, shareholdings, intra-group balances and dividend and realized and unrealized profits or losses on transactions between the consolidated companies.

Elimination is made of intercompany income and expenses, shareholdings, dividends and accounts as well as of realised and unrealised profits and losses on transactions between the consolidated enterprises.

Transactions in currencies other than the entity's functional currency are translated into the functional currency using the exchange rates at the dates of the transactions. Foreign exchange gains and losses resulting from the settlement of such transactions and from the translation of monetary assets and liabilities denominated in foreign currencies at year end exchange rates are generally recognised in profit or loss.

Rental income under operating leases is recognised straight line over the term of the contract. Revenue from sale of apartments are recognised at a point in time when control of the apartment is transferred.

Revenue is measured as the fair value of the consideration received or receivable. Revenue is measured exclusive of VAT, taxes etc.

The value adjustment of investments in associates and portfolio companies comprises value adjustment realized from sale and unrealised value adjustments from any revaluation or impairment of investments in portfolio companies at fair value. Dividend received from investments are included in value adjustments.

Expenses for raw materials and consumables

Expenses for raw materials and consumables comprise the raw materials and consumables consumed to achieve revenue for the year.

Other external expenses

Other external expenses comprise expenses for premises, office expenses, etc.

Staff expenses

Staff expenses comprise wages and salaries as well as payroll expenses.

Other operating income and expenses

Other operating income and other expenses comprise items of a secondary nature to the main activities of the Company, including gains and losses on the sale of intangible assets and property, plant and equipment.

Financial income and expenses

Financial income and expenses include interest, debt, realised and unrealised exchange adjustments, price adjustment of securities, amortisation of mortgage loans as well as additional payments and repayment under the tax prepayment scheme.

Income tax and deferred tax

The company is jointly taxed with Danish Group enterprises. The Danish income tax payable is allocated between the jointly taxed Danish companies based on their proportion of taxable income (full absorption including reimbursement of tax deficits). The jointly taxed companies are taxed under the Danish Tax Payment Scheme. Additions, deductions and allowances are recognised under financial income or financial costs.

The income tax expense or credit for the period is the tax payable on the current period’s taxable income based on the applicable income tax rate for each jurisdiction adjusted by changes in deferred tax assets and liabilities attributable to temporary differences and to unused tax losses.

The current income tax charge is calculated on the basis of the tax laws enacted or substantively enacted at the balance sheet date in the countries where the Company operate and generate taxable income. Management periodically evaluates positions taken in tax returns with respect to situations in which applicable tax regulation is subject to interpretation. It establishes provisions, where appropriate, on the basis of amounts expected to be paid to the tax authorities.

Deferred income tax is recognised on temporary differences arising between the tax bases of assets and liabilities and their carrying amounts in the Financial Statements. Deferred income tax is determined using tax rates (and laws) that have been enacted or substantively enacted by the balance sheet date and are expected to apply when the related deferred income tax asset is realised or the deferred income tax liability is settled.

Deferred income tax assets are recognised only to the extent that it is probable that future taxable profit will be available, against which the temporary differences can be utilised.

Deferred income tax liabilities are provided on taxable temporary differences arising from investments in subsidiaries, except for deferred income tax liability where the timing of the reversal of the temporary difference is controlled by the Company and it is probable that the temporary difference will not reverse in the foreseeable future.

Deferred income tax assets and liabilities are offset when there is a legally enforceable right to offset current tax assets against current tax liabilities and when the deferred income tax assets and liabilities relate to income taxes levied by the same taxation authority on either the same taxable entity or different taxable entities where there is an intention to settle the balances on a net basis.

Intangibles

Goodwill

On initial recognition, goodwill is measured and recognised as the excess of the cost of the acquired company over the fair value of the acquired assets, liabilities and contingent liabilities, as described under Business Combinations.

On recognition of goodwill, the goodwill amount is allocated to those of the Group’s activities that generate separate cash flows (cash-generating units). The determination of cash-generating units is based on the Group’s management structure and internal financial management and reporting.

Goodwill is not amortised, but is tested for impairment at least once a year.

Property, plant and equipment

Property, plant and equipment are measured at cost less accumulated depreciation and impairment losses.

Cost comprises the purchase price and any costs directly attributable to the acquisition until the time when the asset is available for use.

Borrowing costs that are attributable to the construction of property, plant and equipment are added to the costs of the assets during the period that is required to complete and prepare the asset for its intended use.

Expenditures for repairs and maintenance of property, plant and equipment is charged to the profit and loss of the year in which they were incurred. The cost of major renovations and other subsequent expenditure are included in the carrying amount of the asset or recognised as a separate asset, as appropirate, only when it is probable that future economic benefits associated with the item will flow to the Company and the cost of the item can be measured reliably.

Land is not depreciated. Depreciation on other assets is calculated using the straight-line method to allocate their cost or revalued amounts, net of their residual values over their estimated useful lives, as follows:

Buildings

Aircraft

10-50 years

10-20 years

Other fixtures and fittings, tools and equipment 3-6 years

The assets’ residual values and useful lives are reviewed, and adjusted if appropriate, at the end of each reporting period.

Items of property, plant and equipment are derecognised on disposal or when no future economic benefits are expected from their use or disposal. Gains and losses arising from disposal of property, plant and equipment are calculated as the difference between the sales price less sales costs and the carrying amount at the time of sale.

Gains and losses are recognised in the profit and loss as other income or operating expenses.

Investment properties

Investment properties are measured at cost comprising the acquisition price and costs of acquisition. The cost of own constructed investment proporties comprises the acquisition price and expenses directly related to the acquisition, including costs of acquisition and indirect expenses for labour, materials, components and subsuppliers up until the time when the asset is ready for use.

After the initial recognition the investment proporties are measured at fair value.

Investments in subsidiaries

Investments in subsidiaries are recognised and measured under the equity method, which is at the proportionale share of the net asset values in the subsidiaries.

The total net revaluation of investments in subsidiaries is transferred upon distribution of profit to "Reserve for net revaluation under the equity method" under equity. The reserve is reduced by dividend distributed to the Parent Company and adjusted for other equity movements in the subsidiaries.

The carrying amount of equity-accounted investments is tested for impairment if indications of impairment exists.

Investments in portfolio companies etc.

Investments in associates and joint venture at fair value and other equity investments comprise investments in portfolio companies and are measured at fair value on the balance sheet date. Value adjustments are recognised in the income statement.

Investments in associates and joint ventures at equity method

Investments in associates and joint ventures at equity are recognised and measured under the equity method, which is at the proportionale share of the net asset values in the associates and joint ventures.

The total net revaluation of the investments is transferred upon distribution of profit to "Reserve for net revaluation under the equity method" under equity. The reserve is reduced by dividend distributed to the Parent Company and adjusted for other equity movements in the investments.

The carrying amount of equity-accounted investments is tested for impairment if indications of impairment exists.

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value of financial assets traded in active markets (such as publicity traded derivatives and equity securities publicly traded on a stock exchange) are based on quoted market prices at the close of trading on the reporting date.

Investments in portfolio companies traded in an active market are measured on the basis of the last market price. Unlisted portfolio companies are valued either by way of a capital increase round or part sale based on the value of comparable companies as well as by applying traditional measurement methods.

Fair value for unlisted equity securities are determined by management using valuation techniques. Such valuation techniques may include earnings multiples and discounted cash flows. The valuation models are adjusted as deemed necessary for factors such as non-maintainable earnings, tax risk, growth stage and cash traps.

Fair value of certain financial investments are measured at values as communicated by fund management. In determining fair value for other financial investments, the management relies on the financial data of investee portfolio companies or on estimates by the management of the investee portfolio companies as to the effect of future developments. Although management uses its best judgement, and cross-references results of primary valuation models against secondary models in estimating the fair value of investments, there are inherent limitations in any estimation techniques.

The fair value estimates presented herein are not necessarily indicative of an amount the Group could realise in a current transaction. Future confirming events will also affect the estimates of fair value. The effect of such events on the estimates of fair value, including the ultimate liquidation of investments, could be material to the financial statements.

The right-of-use asset and corresponding lease liability will be recognised at the commencement date, the date the underlying asset is ready for use. The lease terms may include options to extend or terminate the lease when it is reasonbly certain that KIRK KAPITAL will exercise that option. Right-of-use assets are measured at cost corresponding to the lease liability recognised, adjusted for any lease incentives received. The lease liabilities are measured at the present value of lease payments to be made over the lease term. The lease payments are discounted.

Depreciations is done following the straight-line method over the lease term or the useful life of the assets.

The KIRK KAPITAL Group applies the short-term lease recognition exemption for lease contracts that, at the commencement date, have a lease term of 12 month or less for all classes of underlying assets, and the exeption for lease contracts for which the underlying asset is of low value. Lease payments on short-term leases and leases of low-value assets are recognised as expenses on a straight-line basis over the lease term.

Right-of-use assets normally have the following lease terms:

Rental of premises 1-30 years

Other assets 1-5 years

Impairment of non-current assets

The carrying aomunts of intangible assets and property, plant and equipment are written down immediately to the recoverable amount if the asset’s carrying amount is greater than its estimated recoverable amount. An impairment loss is recognised in the income statement when the impairment is identified. The recoverable amount is the higher of an asset’s fair value less cost of disposal and value in use. For the purpose of assessing impairment, assets are grouped at the lowest level at which cash flows are separately identifiable (cash-generating units).

Inventories

Inventories comprise property held for sale in the ordinary course of business. They are measured at the lower of cost under the FIFO method and net realisable value. The net realisable value of inventories is calculated at the amount expected to be generated by sale in the process of normal operations with deduction of selling expenses and costs of completion. The net realisable value is determined allowing for marketability, ob-solescence and development in expected sales sum. The cost of goods for resale, raw materials and consumables equals landed cost.

Receivables

On initial recognition, receivables are measured at fair value, and subsequently they are measured at amortised cost. Receivables are written down for expected credit losses.

Prepayments

Prepayments comprise prepaid expenses relating to rent, insurance premiums, subscriptions and interests.

Current Asset Investments

Current Asset Investments, which consists of listed bonds and other investments, are measured at fair value.

Cash and cash equivalents

Cash and cash equivalents comprise cash at bank and in hand.

Equity

Share capital

Ordinary shares are classified as equity. Incremental costs directly attributable to the issue of new shares are shown in equity as a deductions, net of tax, from the proceeds.

Dividend distribution

Proposed dividends are disclosed as a separate item under equity and recognised as a liability when declared.

Financial liabilities

Financial liabilities, including bank and financial loans, trade and other payables, are on initial recognition measured at fair value. The liabilities are subsequently measured at amortised cost.

2

Cash flow statement

The cash flow statement shows the Group's cash flows for the year broken down by operating, investing and financing activities, changes for the year in cash and cash equivalents as well as the Company’s cash and cash equivalents at the beginning and end of the year.

Cash flows from operating activities are calculated as the net profit/loss for the year adjusted for changes in working capital and non-cash operating items such as depreciation, amortisation and impairment losses, and provisions. Working capital comprises current assets less short-term debt excluding items included in cash and cash equivalents.

Cash flows from investing activities comprise cash flows from acquisitions and disposals of intangible assets, property, plant and equipment as well as fixed asset investments.

Cash flows from financing activities comprise cash flows from the raising and repayment of long term debt as well as payments to and from shareholders.

Financial Highlights

Explanation of financial ratios:

Solvency ratio =

Return on equity =

Equity at year-end x 100

Total assets at year-end

Net profit for the year x 100

Average equity

The financial ratios have been computed in accordance with the latest Guidelines issued by the Danish Finance Society.

Critical accounting estimates and judgements

In the preparation of the consolidated financial statements according to IFRS, Management is required to make certain estimates as some financial statement items cannot be reliably measured, but must be estimated as the value of assets and liabilities often depends on future events that are somewhat uncertain.

The judgments, estimates and assumptions made are based on historical experience and other factors that Management considers to be reliable, but which by their very nature are associated with uncertainty and unpredictability. These assumptions may prove incomplete or incorrect, and unexpected events or circumstances may arise. The most critical judgments, estimates and assumptions for the individual items are described below.

Critical accounting estimates

Most of the investments in associates and other investments are measured at fair value on the balance sheet date. When management does not have access to fair values from a liquid market or from portfolio managers the values are primarily estimated by using multiple factors from similar investments thus using level 3 in the fair value hierarchy.

Valuation of investments in associates and joint ventures at fair value is based on estimates and assumptions as regards the fair value of each individual company. These investments amount to DKK 3,020 million in 2020 (DKK 2,697 million in 2019)

For the majority of the investments (DKK 2,368 million in 2020) the fair value is estimated primarily using a valuation model using multiples that are estimated to be a reasonable proxy of markets multiples of comparable companies. The most subjective parameter in the valuation model is the multiples while other parameters are pro-forma adjusted operating income and adjusted net interest bearing debt. If the used multiples changes by 10% then, it would have a P&L impact of around DKKm 340 million.

It is management’s assessment that the assumptions and estimates used are reasonable.

Key Management consists of Executive Board and Board of Directors. The compensation paid or payables to key management for employee services is shown below:

consists of one member whereas the remuneration of the Executive Management and the Board of Directors is disclosed collectively with reference to §98b (3) of the Danish Financial Statements.

11 Investment in associates and joint ventures at fair

profit/loss

10 Investment properties

Investment properties consists of rental properties together with forest and agriculture land. Geographical the properties are located either in Vejle or in the vicinity of Vejle.

Investment properties are on initial recongnition measured at fair value using generally accepted valuation methods. The fair value of rental properties is determined by using either an income capitalization model or basis valuation carried out by independent valuers.

Buildings valued using a capitalizations model is measured at an average rate of return of 6.5% to 7.0%. The average rate of return used, is based on an assessment of locations and condition. A change of the rate of return of 0.5% will impact the value of rental property of approx. DKK 3 million before tax.

The fair value of the forest and agriculture land is estimated at DKK 115,000 per hectare (2019: 115,000 per hectare). A change of the price per hectare of 1% will impact the value of the forest and agriculture land of approx DKK 0.6 million before tax.

Virumgårdsvej

Beck Pack Holdning ApS

Denmark Currency-m Currency-m Currency-m

All shares have nominal value of DKK 1.

There have been no changes in the share capital during the last 5 years.

Each A share has 10 votes at the annual general meeting. Each B share has 1 vote at the annual general meeting.

presented as deferred tax assets

The Group does not have any unrecognized tax loss carryforwards.

17 Related parties

KIRK KAPITAL A/S’ related parties comprise Casper Kirk Johansen, Morten Kirk Johansen, Anders Kirk Johansen and close famlily members and the Board of Directors and the Executive Management of KIRK KAPITAL. Related parties also comprise subsidiaries and associates. Related parties further comprise companies where the mentioned shareholders have significant influence: Selmont A/S, M. KIRK A/S, A. KIRK A/S, C2 A/S, CKKJ Cosmo ApS, JKJ Cosmo ApS, Edith & Godtfred Kirk Christiansens Fond and subsidiaries.

Casper Kirk Johansen, Morten Kirk Johansen, Anders Kirk Johansen have as shareholders significant influence in KIRK KAPITAL A/S.

In the financial year, a limited number of transactions related to services took place between the owners of KIRK KAPITAL A/S and the KIRK KAPITAL Group. These services were paid on normal market terms.

There were no transactions with the Board of Directors or the Executive Management besides transactions related to the employment.

For information about remuneration to the Board of Directors and the Executive Management, see note 4.

Transactions with related parties:

Other related parties

Administration and management Fee Income Rental income Salaries

Year-end balances arising from transactions with related parties: Other related parties

No other year-end balances or transactions have taken place during the year with the Board of Directors, the Executive Management, major shareholders or other related parties.

18 Commitments and contingent liabilities

Contingent liabilities

Remaining commitment regarding participation in investment projects amount to a maximum of DKK 515m.

The Group has provided a guarantee of a maximum of DKK 226m to financial institutions regarding loans and other engagements.

The Group has provided a guarantee of a maximum of DKK 53m to financial institutions in which the Group's associates have loans and other engagements.

Sercurity has been given in Land and buildings and investments properties at a net carrying amount of DKK 519m for the mortgage loans.

The Parent Company has entered into a cash pool agreement. As per. 31 December 2020 the net withdrawl on the cashpool aregreement was DKK 77m.

Financial risk management

Financial risk factors

The Group’s financial risk management is mainly managed by its two investment departments since financial risk exposure is centered around the Group’s strategic and financial investments. Overall risk analysis is performed in connection with setting the Group’s investment strategy which is discussed with and approved by the Board.

The Group’s financial risk profile is mainly dominated by market risk where the Group has high exposure to security prices and moderate exposure to interest rates and currency rates. To a lesser extend the Group is also exposed to Credit risk and Liquidity risk.

Derivatives financial instruments is mainly used to reduce financial risk exposure. Where all relevant criteria are met, hedge accounting is applied to remove the accounting mismatch between the hedging instrument and the hedged item. This will effectively result in recognizing interest expense at a fixed interest rate for the hedged floating rate loans or contracts and investment in foreign currency at the fixed foreign currency rate for the hedged investments. They are presented as current assets or liabilities to the extent they are expected to be settled within 12 months after the end of the reporting period.

For hedges of net investments in foreign currencies and of hedges of financial assset denominated in foreign currencies, the group enters into hedge relationships where the critical terms of the hedging instrument match exactly with the terms of the hedged item. The group therefore performs a qualitative assessment of effectiveness.

The Group uses foreign currency forwards to hedge its exposure to foreign currency risk. Under the Group's policy the critical terms of the forwards must align with the hedged items.

Market risk

Share price risk

The Group's current assets investments is directly exposed to movement in security prices since 51% of current assets investments is listed equities and valued using the observable prices on stock-exchanges. 10% in short-term movement in stock prices would affect the portfolio with 12% in the short term, due to a higher volatility in comparison to the market.

Investments in associates and joint ventures is measured at fair value using non-observable data, but data which to some extend is related to long-term market conditions. Investments in associates and joint ventures is thus not directly exposed to short term stock price movement, but risk is related to Long-term conditions in the market.

Foreign exchange risk

The Group’s currency exposure can be divided in two categories of exposure and risks.

One category is investments denominated in currencies other that DKK/EUR. As per 31 December 2020 investments denominated in currency other than DKK/EUR amount to DKK 1,029 million and the exposure is mainly related to USD. Derivatives is used to hedge the currency risk and the net exposure is reduced to DKK 628 million. The hedging ratio in USD is per 31 December 2020 39%. The average hedging ratio in USD for the year was 37%. The duration of the hedging contracts all have a maturity of less than three months after the end of the reporting period.

A change of 10% in USD exchange rate would have short-term effect on the total comprehensive income by DKK 63 million.

The second category is the underlying currency risk in investment denominated in DKK/EUR where the investments is operating in a global market. Some of the investments have currency exposures due to imbalances in revenue and expenses generated in foreign currencies mostly related to USD. The risk is managed by the investments.

Interest rate risk

The Group’s interest rate risk is mainly related to the groups fixed income investments and the Groups debt instruments.

An increase in interest rate of 1% would negatively affect the fixed income investments with 3,8%.

An increase in interest rate of 1% would positively affect the Groups debt instruments with 2,2%.

The interest rate risk is considered moderate.

The Group’s primary credit exposure is related to fixed income investments, financial instrument, receivables regarding finance leases and cash positions. Major single exposures are either exposures to counterparts with good credit ratings and/or other supporting security measures is in place. The overall credit risk is considered low.

The Group manages its liquidity risk by contiguously monitoring and assessing the liquidity positions. Based on the relatively liquid Current Assets Investments and relatively low level of borrowings and liabilities the liquidity risk is considered low.

The table below analyses the Group’s financial liabilities into relevant maturity groupings based on the remaining period at the balance sheet date to the contractual maturity date. The amounts disclosed in the table are the contractual undiscounted cash flows.

The Group’s financial assets are either measured at amortized cost or fair value through profit and loss. The above specified financial assets and liabilities at fair values have been measured using either from the below three levels of fair value hierarchy:

Level 1:

Quoted prices in active markets for identical markets

Level 2:

Inputs other than quoted prices included within level 1 that are observable for the assets either directly or indirectly

Level 3:

Input for the liabilities and assets that are not based on observable market data. These fair value measurements is form either external portfolio managers or by management estimates using multiples from similar investments or using fair value calculations models such as DCF models.

20 Fee to auditors appointed at the general meeting

21 Lease liabilities

Lease liabilities expiring within the following periods from the balance sheet date:

22 Events after the balance sheet date

No events materially affecting the assessment of the Annual Report have occurred after the balance sheet date.

23 List of group companies

in the profit and loss statement

Interest expenses related to lease liabilites

Expenses relating to short term leases, not capitalized Expenses relating to leases of low-value assets, not capitalized

In 2020 the Group has paid DKK 2,0m regarding lease agreements where of interest expenses related to lease liabilities amount to DKK 0,1m and repayment of lease liability a to DKK 1,9m.

Gunhild

Edith Kirk A/S*

Marie Kirk A/S*

Marianne Kirk A/S*

Anja Kirk A/S*

KIRK Aviation A/S*

KKAG Komplementarselskab ApS*

KA1

*Financial Statements are presented in USD, which is the fundctional currency of the Company.

The Board of Directors and the Executive Board have today considered and approved the annual report of Kirk Kapital A/S for the financial year 1 January31 December 2020.

The Annual report has been prepared in accordance with International Financial Reporting Standards as adopted by the EU, and further requirements in the Danish Financial Statements Act.

In our opinion, the consolidated financial statements and the parent financial statements give a true and fair view of the Group’s and the Parent’s financial position at 31 December 2020 and of the results of their operations and cash flows for the financial year 1 January-31 December 2020.

In our opinion, the management commentary contains a fair review of the development of the Group's and the Parent’s business and financial matters, the results for the year and of the Parent’s financial position and the financial position as a whole of the entities included in the consolidated financial statements, together with a description of the principal risks and uncertainties that the Group and the Parent face.

We recommend the annual report for adoption at the Annual General Meeting.

Vejle, 27 April 2021

Executive Board Kim Gulstad

Board of Directors Casper Kirk Johansen, Chairman Peter Beske Nielsen

Birgitte Nielsen

Jens Winther Moberg

Opinion

We have audited the consolidated financial statements and the parent financial statements of Kirk Kaptal A/S for the financial year 01.01.202031.12.2020, which comprise the statement of comprehensive income, balance sheet, statement of changes in equity, cash flow statement and notes, including a summary of significant accounting policies, for the Group as well as the Parent. The consolidated financial statements and the parent financial statements are prepared in accordance with International Financial Reporting Standards as adopted by the EU and additional requirements of the Danish Financial Statements Act.

In our opinion, the consolidated financial statements and the parent financial statements give a true and fair view of the Group’s and the Parent’s financial position at 31.12.2020, and of the results of their operations and cash flows for the financial year 01.01.2020-31.12.2020 in accordance with International Financial Reporting Standards as adopted by the EU and additional requirements of the Danish Financial Statements Act.

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing (ISAs) and the additional requirements applicable in Denmark.

Our responsibilities under those standards and requirements are further described in the Auditor’s responsibilities for the audit of the consolidated financial statements and the parent financial statements section of this auditor’s report.

We are independent of the Group in

accordance with the International Ethics Standards Board of Accountants' Code of Ethics for Professional Accountants (IESBA Code) and the additional requirements applicable in Denmark, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Statement on the management commentary

Management is responsible for the management commentary.

Our opinion on the consolidated financial statements and the parent financial statements does not cover the management commentary, and we do not express any form of assurance conclusion thereon.

In connection with our audit of the consolidated financial statements and the parent financial statements, our responsibility is to read the management commentary and, in doing so, consider whether the management commentary is materially inconsistent with the consolidated financial statements and the parent financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated.

Moreover, it is our responsibility to consider whether the management commentary provides the information required under the Danish Financial Statements Act.

Based on the work we have performed, we conclude that the management commentary is in accordance with the consolidated financial statements and the parent financial statements and has been prepared in accordance with the requirements of the Danish Financial Statements Act. We did not identify any material misstatement of the management commentary.

Management's responsibilities for the consolidated financial statements and the parent financial statements

Management is responsible for the preparation of consolidated financial statements and parent financial statements that give a true and fair view in accordance with International Financial Reporting Standards as adopted by the EU and additional requirements of the Danish Financial Statements Act, and for such internal control as Management determines is necessary to enable the preparation of consolidated financial statements and parent financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the consolidated financial statements and the parent financial statements, Management is responsible for assessing the Group’s and the Parent’s ability to continue as a going concern, for disclosing, as applicable, matters related to going concern, and for using the going concern basis of accounting in preparing the consolidated financial statements and the parent financial statements unless Management either intends to liquidate the Group or the Entity or to cease operations, or has no realistic alternative but to do so.

Auditor's responsibilities for the audit of the consolidated financial statements and the parent financial statements

Our objectives are to obtain reasonable assurance about whether the consolidated financial statements and the parent financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs and the additional requirements applicable in Denmark will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these consolidated financial statements and these parent financial statements.

As part of an audit conducted in accordance with ISAs and the additional requirements applicable in Denmark, we exercise professional judgement and maintain professional scepticism throughout the audit.

We also:

• Identify and assess the risks of material misstatement of the consolidated financial statements and the parent financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting

from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

• Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Group’s and the Parent’s internal control.

• Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by Management.

• Conclude on the appropriateness of Management’s use of the going concern basis of accounting in preparing the consolidated financial statements and the parent financial statements, and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Group's and the Parent’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the consolidated financial statements and the parent financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the Group and the Entity to cease to continue as a going concern.

• Obtain sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the Group to express an opinion on the consolidated financial statements. We are responsible for the direction, supervision and performance of the group audit. We remain solely responsible for our audit opinion.

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

Vejle, 27 April 2021

Deloitte Statsautoriseret Revisionspartnerselskab

CVR No 33 96 35 56

Thomas Rosquist Andersen

State Authorised Public Accountant

MNE no mne31482

Søren Alsen Lauridsen

State Authorised Public Accountant

MNE no mne40040

• Evaluate the overall presentation, structure and content of the consolidated financial statements and the parent financial statements, including the disclosures in the notes, and whether the consolidated financial statements and the parent financial statements represent the underlying transactions and events in a manner that gives a true and fair view.